For anyone looking to venture into Forex trading, the idea of navigating the largest and most liquid market in the world can be both exciting and daunting. With trillions of dollars traded daily, the potential for profit is significant—but so is the risk. That’s where a Forex demo account comes into play. A demo account allows new traders to practice trading without risking real money, offering a risk-free environment to learn the ropes, develop strategies, and build confidence. In this comprehensive guide, we’ll explore how to effectively use a Forex demo account to practice and prepare for live trading.

1. Introduction to Forex Demo Accounts

A Forex demo account is a simulated trading environment that replicates the live Forex market using virtual funds. This type of account allows traders to experience real-time trading conditions without the financial risk associated with live trading. Whether you’re new to Forex trading or an experienced trader looking to test new strategies, a demo account provides a safe space to practice and refine your skills.

Demo accounts are typically offered by Forex brokers and come equipped with the same tools, charts, and market data that are available in live accounts. This makes them an invaluable resource for anyone looking to understand the mechanics of Forex trading before committing real money.

2. Benefits of Using a Forex Demo Account

Practicing with a demo account offers several key benefits that can help traders build a solid foundation for future success in live trading.

Risk-Free Learning Environment

The primary benefit of a demo account is that it allows traders to learn and experiment without risking real money. This is particularly important for beginners who are still familiarizing themselves with the Forex market and trading platforms.

Familiarization with Trading Platforms

Each Forex broker offers a unique trading platform with its own set of features and tools. A demo account allows traders to explore these platforms, understand how to place trades, and utilize different features without the pressure of live trading.

Strategy Development and Testing

A demo account is an ideal environment for developing and testing trading strategies. Traders can experiment with different approaches, analyze the outcomes, and refine their strategies based on

performance, all without the financial consequences of real trading.

Building Confidence

Trading in the Forex market can be intimidating, especially for beginners. Using a demo account helps traders build confidence in their trading decisions and strategies, making them better prepared for the challenges of live trading.

3. How to Set Up a Forex Demo Account

Setting up a Forex demo account is a straightforward process, typically involving the following steps:

Choose a Forex Broker :

Start by selecting a reputable Forex broker that offers demo accounts. Consider factors such as the broker’s platform, customer support, and educational resources.

Sign Up for a Demo Account:

Visit the broker’s website and sign up for a demo account. You’ll need to provide some basic information, such as your name and email address.

Download the Trading Platform:

Once your account is set up, download the broker’s trading platform if necessary. Many brokers offer web-based platforms that don’t require a download.

Log In and Explore:

Log in to your demo account using the credentials provided by the broker. Take some time to explore the platform, familiarize yourself with its features, and start placing simulated trades.

4. Key Features to Explore in a Demo Account

To get the most out of your Forex demo account, it’s important to explore and understand the key features available on the trading platform.

Trading Platform Interface

The trading platform is your gateway to the Forex market. Spend time navigating the interface,

understanding where to find key information, and learning how to execute trades.

Example: Familiarize yourself with the dashboard, where you can monitor your open trades, account balance, and market data. Explore the menu options for accessing charts, indicators, and trading tools.

Ready to Start Trading?

With G2G Group LTD, creating your account and withdrawing funds becomes much easier. This allows you to seamlessly navigate the complex landscape of the Forex trading sector without any hassles.

Charting Tools and Indicators

Charts are a fundamental tool in Forex trading, allowing you to analyze price movements and identify trends. Most trading platforms offer a variety of chart types (e.g., candlestick, bar, line) and technical indicators (e.g., moving averages, RSI, MACD).

Example: Experiment with different chart types to see how they display price data. Add indicators like moving averages to your charts and observe how they can help you identify potential trading opportunities.

Order Types and Execution

Understanding how to place different types of orders is crucial for effective trading. Demo accounts allow you to practice placing market orders, limit orders, stop orders, and more.

Example: Place a market order to buy a currency pair at the current market price. Next, try placing a limit order to buy the same pair at a lower price, and a stop order to sell if the price drops below a certain level.

Risk Management Tools

Risk management is a critical aspect of successful trading. Most trading platforms offer tools such as stop-loss orders and take-profit orders to help manage risk.

Example: Practice setting stop-loss orders on your trades to automatically close a position if the market moves against you. Experiment with take-profit orders to lock in profits when the market reaches a certain level.

5. Strategies for Practicing with a Demo Account

To make the most of your time in a demo account, it’s essential to practice with purpose and structure.

Developing a Trading Plan

A trading plan outlines your strategy, including your trading goals, risk tolerance, and the criteria you use to enter and exit trades. Developing a trading plan while using a demo account can help you stay disciplined and focused.

Example: Your trading plan might specify that you’ll only trade major currency pairs like EUR/USD, use a stop-loss of 2% on each trade, and only enter trades when specific technical indicators align.

Simulating Real Trading Conditions

To prepare for live trading, it’s important to treat your demo account as if it were a live account. This means adhering to your trading plan, managing your risk, and avoiding reckless trades.

Example: If you plan to trade with $10,000 in a live account, set your demo account to the same amount. This will help you practice risk management and position sizing in a realistic manner.

Testing Different Trading Strategies

A demo account is the perfect environment for testing different trading strategies. Whether you’re interested in scalping, day trading, or swing trading, you can experiment with various approaches and analyze the results.

Example: Test a scalping strategy that involves making quick trades to capture small price movements. Track your results over a series of trades to determine if the strategy is effective.

Ready to Start Trading?

With G2G Group LTD, creating your account and withdrawing funds becomes much easier. This allows you to seamlessly navigate the complex landscape of the Forex trading sector without any hassles.

6. Transitioning from Demo to Live Trading

Once you’ve gained experience and confidence in a demo account, the next step is transitioning to live trading. However, this transition requires careful consideration and adjustment.

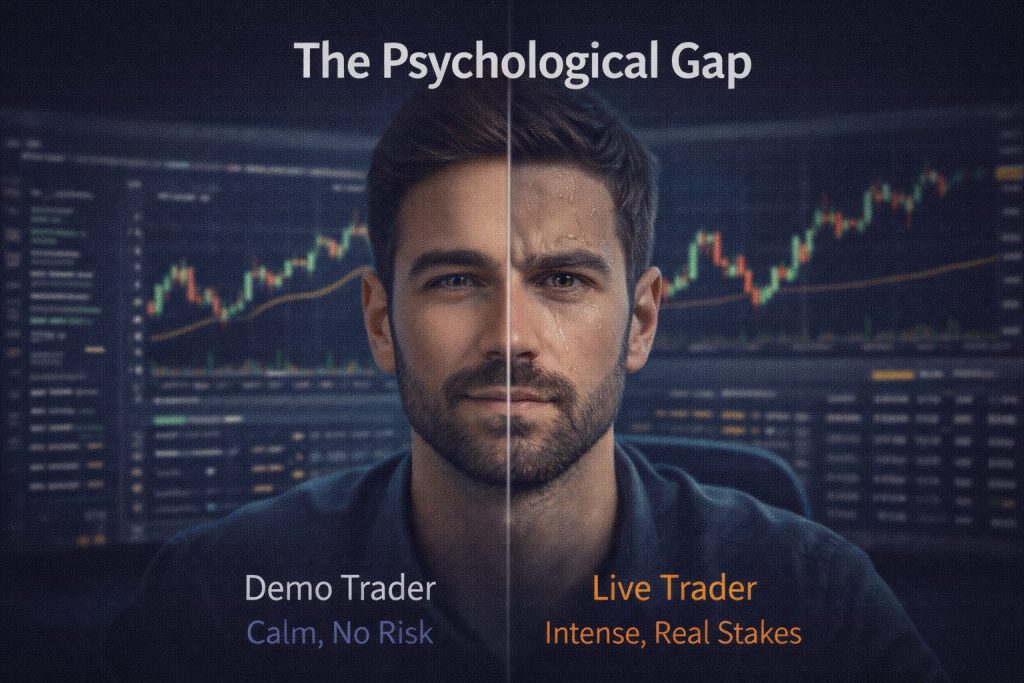

Recognizing the Differences

While a demo account provides a valuable learning experience, there are significant differences between demo and live trading. The most important difference is the emotional aspect—trading with real money can evoke fear, greed, and other emotions that can influence your decisions.

Example: In a demo account, you might easily hold onto a trade through a drawdown, knowing that it’s only virtual money at risk. In a live account, the fear of losing real money might lead you to close the trade prematurely.

Psychological Adjustments

Managing emotions is one of the biggest challenges in live trading. It’s essential to prepare mentally for the psychological aspects of trading with real money.

Example: Before transitioning to live trading, practice mindfulness techniques or develop routines that help you stay calm and focused during trading sessions.

Gradual Transition Approach

Instead of jumping straight into live trading with your full capital, consider starting with a small amount of money. This allows you to ease into live trading and make adjustments as needed.

Example: If you plan to trade with $10,000, start with $1,000 in your live account. As you gain confidence and experience, gradually increase your trading capital.

7. Common Mistakes to Avoid When Using a Demo Account

While a demo account is an excellent tool for learning, there are common mistakes that can hinder your progress.

Overtrading and Lack of Discipline

One of the most common mistakes is overtrading—making too many trades without a clear strategy. In a demo account, the lack of real financial risk can lead to reckless trading behavior.

Avoidance Tip: Stick to your trading plan and only make trades that align with your strategy. Avoid the temptation to overtrade just because it’s a demo account.

Ignoring the Importance of Emotional Control

Emotional control is critical in live trading, but it’s often overlooked in a demo account. Traders who don’t practice managing their emotions in a demo account may struggle when they start trading with real money.

Avoidance Tip: Treat your demo account with the same seriousness as a live account. Pay attention to how you react to winning and losing trades, and practice maintaining emotional discipline

Treating the Demo Account as a Game

It’s easy to fall into the trap of treating a demo account like a video game, where the goal is to make as much virtual money as possible without any real consequences. This mindset can be detrimental when transitioning to live trading.

Avoidance Tip: Remember that the purpose of a demo account is to prepare for real trading. Focus on learning and refining your skills rather than chasing high returns in the demo environment.

8. Conclusion: Maximizing the Benefits of a Forex Demo Account

A Forex demo account is an invaluable tool for traders at all levels, offering a risk-free environment to learn, practice, and develop strategies. By taking the time to explore the trading platform, test different strategies, and treat the demo account as seriously as a live account, you can build a solid foundation for future success in Forex trading. Remember that the ultimate goal of using a demo account is to prepare yourself for the challenges of live trading. By approaching it with the right mindset and discipline, you’ll be better equipped to navigate the Forex market and achieve your trading goals.