Table of Contents

- Portfolio Diversification: An Introduction

- Why diversify through Forex trading?

- Benefits of Forex Trading

- How Forex Differs from Other Asset Classes

- Important Strategies to Diversify with Forex

- Risk Management in Forex Trading

- Adding Forex to a Traditional Portfolio

- Case Studies: Successful Portfolio Diversification Using Forex

- Common Forex Diversification Mistakes

- Conclusion

- Frequently Asked Questions

Portfolio Diversification: An Introduction

Portfolio diversification is a general principle of investment in wide classes of assets, industries, and geographic regions, with the purpose of reducing risk. This is so that underperformance in any one asset class will have minimal impact on overall portfolio performance.

While traditional diversification can be a mix of stocks and bonds or even real estate, the addition of Forex trading to a portfolio brings an added dimension of diversification that helps mitigate risks due to currency fluctuations, along with reaping benefits from opportunities provided by global markets.

Why Consider Forex Trading for Diversification?

Forex trading is the activity of trading a pair of currencies in the global market. This is the biggest and most liquid market on the planet, as it transacts over $6 trillion daily. To investors who wish to diversify into other classes, Forex trading is rich with such advantages.

Advantages of Forex Trading

Liquidity

The Forex market is open to trading 24 hours a day, five days a week. This allows for unmatched liquidity and flexibility to traders. This liquidity essentially means that trades can be better executed in a short amount of time and at the price desired, which is particularly important for investors eager to make quick portfolio adjustments.

Global Exposure

Trading in Forex allows an investor exposure to the general state of economies around the world. It enables investors who want to trade economic growth with countries performing well, even when their local markets are not performing as well.

Hedging Against Currency Risk

Internationally exposed investors can hedge against possible currency risks through Forex trading. A trader can enter positions in the Forex market and get protection from unfavorable currency movements, which could hurt one’s international investments.

Low Correlation with Other Asset Classes

Most of the time, Forex trading is poorly correlated with traditional asset classes like stocks and bonds. What this low correlation means is that Forex can help reduce the overall volatility of a diversified portfolio.

Ready to Start Trading?

With G2G Group LTD, creating your account and withdrawing funds becomes much easier. This allows you to seamlessly navigate the complex landscape of the Forex trading sector without any hassles.

How Forex Differs from Other Asset Classes

There are numerous ways whereby Forex trading is different from other asset classes. Some of these include:

Missing Central Exchange

Unlike commodities or stocks, Forex is traded over the counter. Hence, there is no central exchange that exists for Forex. This is another key reason for high liquidity and accessibility in this market.

Leverage

Forex trading allows large positions of traders with relatively small capital. This leverage can give high profits but also increases risks.

Market Hours

The Forex market operates 24 hours a day, meaning one can continuously trade across different time zones. In contrast, the nature of stock markets is fixed trading hours.

Major Ways of Diversification with Forex

Choosing Currency Pairs

Proper selection of currency pairs is the quintessence for effective diversification. The so-called major pairs, including EUR/USD, USD/JPY, and GBP/USD, will have the most liquidity and be widely traded by offering lower spreads and higher stability. Adding exotics and minors to your portfolio may create value in diversifying, given the possibility of exposure to emerging markets and less correlated currencies.

For example, a portfolio with the major pairing of the EUR/USD and an exotic pairing like the USD/TRY (U.S. Dollar/Turkish Lira) can have its cake and eat it in terms of stability versus the possibility of high returns from emerging markets.

Hedging Strategies

Hedging is a way of limiting risk by taking offsetting positions in related markets. One of the most vital aspects of hedging in Forex trading is protection against adverse movements in currencies, which might have an effect on other investments in your portfolio.

Example: If you have a significant long position in European stocks, you can hedge the risk of a decline in the Euro by selling the EUR/USD pair forward.

Correlation and Diversification

Knowing the correlation between currency pairs and other assets in your portfolio will greatly help in effective diversification.

Risk Management in Forex Trading

Understanding Leverage and Its Risks

The leverage facility in Forex trading allows traders to hold bigger positions with relatively small capital. This is the double-edged sword where profits and losses are both magnified.

Stop-Loss Orders and Position Sizing

Stop-loss orders limit potential losses. Proper position sizing ensures no single trade can damage the overall portfolio.

Adding Forex to a Traditional Portfolio

Balancing Forex Against Stocks and Bonds

Forex may offer a hedge against economic downturns when equities and bonds do poorly.

Geographical Diversification Using Forex

Forex allows exposure to global markets without owning foreign stocks or bonds.

Case Studies: Successful Portfolio Diversification with Forex

Case Study 1: The 2008 Financial Crisis

Forex traders using safe-haven currencies like JPY offset losses from collapsing stock markets.

Case Study 2: Post-Brexit Volatility

Shorting GBP/USD helped mitigate losses during the pound’s sharp decline.

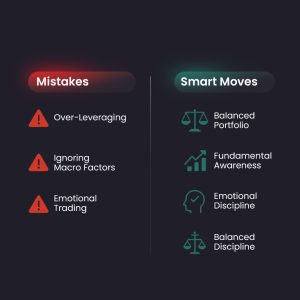

Common Forex Diversification Mistakes

Over-leveraging

High leverage increases potential losses.

Ignoring Macro-Economic Factors

Interest rates, inflation, and geopolitical events strongly influence currency movement.

Emotional Trading

Fear and greed cause impulsive trades and major losses.

Conclusion

Diversification of the portfolio through Forex trading offers an unrivaled avenue to enhance returns, reduce risk, and tap international economic trends.

Frequently Asked Questions

1. Is Forex trading a good way to diversify my investment portfolio?

Yes. Forex offers low correlation with traditional assets and provides global exposure, making it a strong diversification tool.

2. Can Forex help protect my portfolio during market crashes?

Yes. Safe-haven currencies like JPY and CHF often strengthen during crises, helping offset losses in equities.

3. How much of my portfolio should be allocated to Forex?

Most experts recommend 5–15%, depending on your risk tolerance and experience level.

4. Is Forex too risky for beginners?

It can be risky, but with proper risk management, low leverage, and education, beginners can trade safely.

5. Does Forex trading require large capital?

No. Forex allows small starting capital thanks to flexible lot sizes.