Successful trading requires more than intuition — it demands consistent, data-driven market analysis. At G2G Group, we provide traders with clear insights into Forex, gold, indices, and crypto markets, helping them make informed decisions in fast-moving conditions. This guide explains the key components of market analysis and how traders can use it to stay ahead.

What Is Market Analysis in Trading?

Market analysis is the process of evaluating financial markets using data, price behavior, and fundamental factors to determine potential trade opportunities. The goal is to understand what drives price movements and anticipate where markets may move next.

In Forex and commodities such as gold, analysis helps traders:

- Identify trend direction and momentum

- Time entry and exit points

- Understand macroeconomic influences

- Evaluate risk and set appropriate stop-loss levels

- Spot potential reversals or breakouts

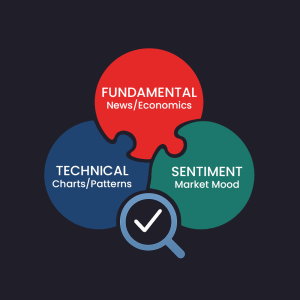

Types of Market Analysis Every Trader Should Use

1. Technical Analysis

Technical analysis focuses on price action, patterns, and market psychology. Traders rely on charts and indicators to predict future price movements. Popular tools include:

- Candlestick patterns

- Trendlines and channels

- Moving averages (MA)

- RSI, MACD and momentum oscillators

- Support and resistance zones

Technical analysis is essential for day traders and swing traders who depend on precise timing.

2. Fundamental Analysis

Fundamental analysis examines economic data, geopolitical events, interest rates, and global financial conditions. Markets move based on real-world events, especially:

- Central bank decisions

- Inflation reports

- Non-Farm Payrolls (NFP)

- GDP data

- Consumer sentiment and manufacturing surveys

This approach is crucial for medium-to-long term strategies, particularly in Forex and gold trading.

3. Sentiment Analysis

Sentiment analysis gauges the mood of the market — whether traders are risk-on or risk-off. It often shifts based on major news, economic stress, or political uncertainty.

Examples include:

Ready to Start Trading?

With G2G Group LTD, creating your account and withdrawing funds becomes much easier. This allows you to seamlessly navigate the complex landscape of the Forex trading sector without any hassles.

- Fear driving capital toward gold and safe-haven currencies

- Risk appetite boosting equities and risk-ier currencies

- Crypto momentum influenced by investor enthusiasm

Forex Market Analysis

The Forex market is shaped by interest rates, economic strength, and global liquidity. Proper analysis helps traders anticipate currency volatility and major trend shifts.

Key factors affecting Forex movements:

- Central bank policy (Fed, ECB, BoE, BoJ)

- Employment and inflation data

- Geopolitical stability

- Market liquidity during sessions (Asian, London, New York)

Traders combining technical and fundamental analysis typically achieve the most consistent results.

Gold (XAU/USD) Market Analysis

Gold is one of the most actively traded commodities and is highly sensitive to risk sentiment. Skilled traders monitor the real-time factors that influence XAU/USD price movements.

Main drivers of gold prices:

- US Dollar strength or weakness

- Interest rate expectations

- Inflation concerns

- Geopolitical tensions

- Bond yields and real rates

Gold traders rely on both technical tools (Fibonacci, support zones) and macroeconomic analysis to capture strong moves.

Crypto Market Analysis

The crypto market is more volatile than traditional markets, requiring disciplined analysis and risk control. Traders look at:

- Market sentiment and liquidity

- Regulatory developments

- Blockchain adoption trends

- Technical patterns and momentum indicators

Crypto analysis often overlaps with risk sentiment seen in the stock and commodities markets.

How to Use Market Analysis in Your Trading Strategy

- Identify trend direction: analyze long-term and short-term movements.

- Wait for confirmation: avoid impulsive entries.

- Use multi-timeframe analysis: combine daily, 4H, and 1H charts.

- Monitor economic calendars: key events can trigger major moves.

- Apply risk management: never trade without a stop-loss.

Combining techniques provides a clearer, more reliable market picture.

Final Thoughts

Market analysis is the foundation of every successful trading strategy. Whether you focus on Forex, gold, crypto, or global assets, understanding price behavior and economic conditions will improve your decision-making and long-term results.

Stay updated with G2G Group’s analysis to gain a competitive trading edge.

Frequently Asked Questions (FAQs)

What is market analysis in trading?

Market analysis is the process of studying price movements, economic data, and market sentiment to understand trends and identify potential trading opportunities across Forex, gold, crypto, and other assets.

Why is market analysis important for traders?

Market analysis helps traders make informed decisions, reduce risk, identify high-probability setups, and understand the factors influencing price movements. It is essential for improving accuracy and consistency in trading.

What types of market analysis are used in Forex and gold trading?

The three main types are technical analysis, fundamental analysis, and sentiment analysis. Successful traders often combine all three to gain a complete view of market conditions.

How often should I perform market analysis?

Most traders analyze markets daily. Short-term traders may monitor charts multiple times throughout the day, while long-term traders may update their analysis weekly.

Does market analysis guarantee profitable trades?

No. Market analysis increases the probability of making informed and strategic decisions, but market conditions can change rapidly. Risk management is always necessary.

Can beginners learn how to do market analysis?

Yes, Beginners can learn market analysis through educational resources, charts, economic calendars, and practice. Over time, identifying trends and patterns becomes easier.

Which tools are best for Forex and gold market analysis?

Common tools include candlestick charts, moving averages, RSI, MACD, support and resistance levels, economic calendars, and news feeds that cover global financial events.

How does fundamental analysis affect gold and Forex markets?

Economic factors such as interest rates, inflation, geopolitical tensions, and central bank decisions have a direct impact on the value of currencies and gold prices.

Is sentiment analysis useful for traders?

Yes, Sentiment analysis helps traders understand whether the market is risk-on or risk-off, which strongly influences currency pairs, gold, indices, and crypto assets.

Where can I get reliable market analysis?

Reliable market analysis is available through financial news sources, economic data providers, trading platforms, and professional broker websites that offer insights and market updates.